WHAT DOES BIDEN MEAN FOR IMMIGRATION? ***Important Caveat - we cannot predict the future - these are our best predictions based on what we have seen from the Obama administration, what has changed with the Trump administration, and what the Biden transition team has said thus far.*** 1. General Changes. USCIS during the Trump administration has been marked by grave incompetence and sometimes outright violation of law. As a result, we have seen the beginning of an exodus of companies and projects to Canada and a preference for remote-only work in order to avoid a draconian and xenophobic immigration system. It is our hope that a more competent, fair, and just immigration system will bring that work and those tax dollars back to the US at a time when our country most needs it. Here are the general changes we expect to see during the Biden administration (but keep in mind a change in culture can take time): A return to transparency , open communication , and intention to follow the law ; Less baseless Requests for Evidence and Denials; Easier access to Infopass appointments and USCIS agents by phone; Greater communication between USCIS and the public, including a return to certain liaison meetings; More flexibility for individuals in removal hearings who have US family and have spent many years in the US; Generally more c ompetence , organization , and modernization. 2. Specific Changes Travel Bans: We expect the Biden administration to reverse most if not all of the travel bans. We know they plan to reverse the "Muslim Ban" on Day 1. We do expect them to also reverse travel bans from Europe to the US in short order given that we have higher levels of COVID than Europe, and given that it makes little public health sense to send someone from a country with low COVID rates (like Greece) to a country with high rates (like Mexico) for 14 days in order to enter the US. Embassy and Consulate Openings: We expect the Biden administration to hasten the reopening of US Embassies and Consulates abroad providing easier access to obtaining new visas. DACA: We expect the Biden administration to reinstate DACA to its former status. Because the Trump administration failed to show it was unconstitutional, DACA may even be expanded under the Biden administration. TPS: We expect the Biden administration to reinstate TPS for most holders. Public Charge Additions: We also expect the Biden administration to reverse the new public charge requirements the Trump administration added to nearly all immigration processes. These additions have been stuck down on several occasions by federal courts. The public charge rule still stands, but it should revert to its prior incarnation relieving applicants of overly burdensome disclosures and requirements. Refugees: We also expect the Biden administration to increase the number of refugees the US accepts back to historic levels.

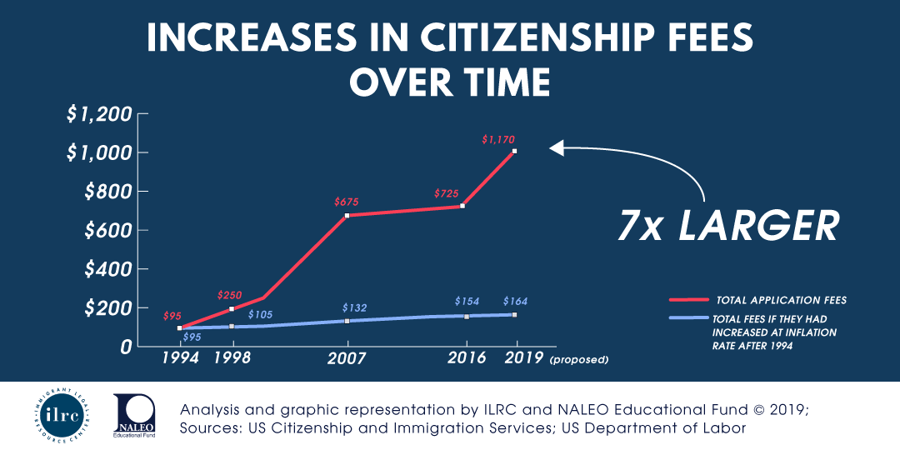

Here are a summary of some of the most common fees: Business Immigration O-1/P-1 Petition: now $705 (previously $460) O-2/P-1S Petition: now $705 (previously $460) [note, up to 25 x O-2 and P-1S beneficiaries can still go in one petition] H-1B Petition: $555 (previously $460) L-1 Petition: $805 (previously $460) I-140 Petition: $555 (went down - previously $700) Family Immigration 1st Green Card Petition inside US: $1690 + $590 travel permit + $550 work permit (used to be $1760 for everything) Removal of Conditions on Green Card: $760 (previously $595) Citizenship: $1,170 (previously $725) 601A Waiver: $960 (previously $630)

As we know, the Supreme Court sided with DACA holders against the Trump administration. On account of the Supreme Court decision, USCIS is finally accepting new applications (not just renewals) and travel permit applications (advance parole). Although USCIS illegally rejected some applications post the Supreme Court decision (and subsequently lied about the reasoning), a federal court has now ordered them to follow the law. WHAT THIS CHANGES 1. We can now apply for brand new DACA applicants; and 2. For those who already have DACA, we can apply for a travel permit (also known as Advance Parole). WHY A TRAVEL PERMIT IS SO IMPORTANT (AND URGENT) The travel permit can make a huge difference for DACA holders. If you did not enter the US on a visa and you are married to a US citizen (or you have a US citizen child who is 21 or older), you have to obtain a pardon (waiver) and travel out of the United States to get your green card. This is not only an expensive and time consuming process, but also discretionary and has gotten only harder under this administration. However, if you obtain a travel permit and you travel outside of the US and come back on your permit, you no longer need a waiver ("pardon") if you apply for a green card through an immediate US relative (spouse or child who is 21 years old or above). We highly encourage you to now apply for the travel permit if you qualify/have need. Here are the reasons for travel that are permitted (and that we will need to prove): Humanitarian: For example: travel to obtain medical treatment, attend funeral services for a family member, or visit a sick or elderly relative. Educational: For example: semester abroad programs or academic research. Employment: For example: overseas assignments, interviews, conferences, training, or meetings for work If you would like to apply, please let us know right away, we do not know how long this opportunity will last.

The Trump administration has backed off its dangerous and self-destructive student visa regulations. Foreign students will now be allowed to remain in the US in legal status on student visas while pursuing online coursework. The financial harm alone to US universities under the ban would have had dreadful lasting effects on the US education system and economy. Kudos to those universities and lawyers that stopped this needless self-infliction to the US economy and educational system.

Today's Executive Order Will Affect Many, But It Is Limited In Scope Who this does NOT affect: This does not affect anyone already in the US (even if changing status to an H-1B, L-1, etc); This does not affect anyone outside the US who already has their visa; This does not affect anyone applying for other visas - like O, P, B visas, etc. Who this does affect: New H-1B, H-2B, L-1, and J-1 applicants who are: 1) outside of the US and 2) do not have their actual visa yet. H ow long will this last: The proclamation is currently scheduled to end December 31, 2020. Is there a work around? It looks like yes. If you have a valid B1/B2 or other non-immigrant visa (ESTA will not work), you can enter the US and then change status here to one of the banned categories. Remember, there are still limits on travel from certain countries: The travel ban from Europe, China, Iran, and Brazil is still in place. If you need to travel to the US on a B1/B2 from one of those countries, you will need to spend at least 14 days in another country (that is not subject to the travel ban), before entering the US. Click here for all COVID updates. Click here to read the entire proclamation.

Quick Summary I-140 (Employment Green Card Petition) Starting immediately, you can upgrade any pending petition to Premium Processing and file a new I-140 with Premium Processing O, P, L, & E Visa Petitions: Starting June 8th, you can upgrade any pending petition to Premium Processing. Starting June 22nd, you can submit a new O and P visa concurrently with Premium Processing H-1B Visas (Non-exempt - this is most of them): Starting June 22nd, H-1B applications can upgrade to Premium Processing Detailed U.S. Citizenship and Immigration Services today announced that it will resume premium processing for Form I-129, Petition for a Nonimmigrant Worker and Form I-140, Immigrant Petition for Alien Workers, in phases over the next month. Effective June 1, 2020, USCIS will accept Form I-907, Request for Premium Processing Service for all eligible Form I-140 petitions. Effective June 8, USCIS will accept premium processing requests for: H-1B petitions filed before June 8 that are pending adjudication and are cap-exempt (for example, petitions filed by petitioners that are cap-exempt and petitions filed for beneficiaries previously counted toward the numerical allocations). All other Form I-129 petitions (non H-1B petitions) for nonimmigrant classifications eligible for premium processing filed before June 8 that are pending adjudication. Effective June 15, USCIS plans on resuming premium processing for: H-1B petitions requesting premium processing by filing an I-907 concurrently with their I-129 (or request for a petition filed on or after June 8) and are exempt from the cap because: The employer is cap-exempt or because the beneficiary will be employed at a qualifying cap-exempt institution, entity or organization (such as an institution of higher education, a nonprofit research organization or a governmental research organization); or The beneficiary is cap-exempt based on a Conrad/IGA waiver under INA section 214(l). Effective June 22, USCIS plans on resuming premium processing for all other Form I-129 petitions, including: All H-1B cap-subject petitions (including those for fiscal year 2021), including change of status from F-1 nonimmigrant status, for both premium processing upgrades and concurrently filed I-907s. All other Form I-129 petitions for nonimmigrant classifications eligible for premium processing and requesting premium processing by filing an I-907 concurrently with their I-129.

WHAT'S COMING BACK: Los Angeles City and County USCIS Offices will start Naturalization interviews on June 16 with social distancing limitations as a priority. Los Angeles City and County USCIS Offices will conduct limited Naturalization ceremonies June 27 and 28 with social distancing limitations as a priority. Los Angeles City and County USCIS Offices may be accepting emergency Infopass appointments now, but we are awaiting clarification. WHAT'S NOT READY YET No other interviews with start dates are planned or can be announced right now (this includes green card interviews) No news on biometrics appointments as of now.

UNEMPLOYMENT IN THE TIME OF CORONAVIRUS We are receiving a number of inquiries regarding unemployment. This is a complicated subject and each case is different, but below is some foundational information that may assist you and/or your workers in deciding the best path forward. Basics Regarding Unemployment The federal-state unemployment insurance system (UI) helps many people who have lost their jobs by temporarily replacing part of their wages while they look for work. It is a form of social insurance because employers pay into the system for their employees. Thus, it is not considered to be a "cash" or "cash equivalent" benefit, but rather, an "earned" benefit. Non-Immigrant Visa Holders (O, P, L, H) If you are a non-immigrant visa holder working in the US, it may be possible to qualify for unemployment, however, it is not recommended. It is important to remember that non-immigrant visa holders' status is dependent upon their work in the US. Thus, if they lose that job, in most cases, they have 60 days to find a new position or leave the US. Remaining in the US and living on unemployment will be evidence of falling out of status and could have long term negative consequences. What if you have to layoff a foreign worker or the foreign worker you petitioned for loses their job? In most of these cases, the petitioner and employer(s) are jointly liable to pay for that worker's transportation to return to the alien's last place of residence outside of the US. Those Seeking Permanent Residence If you are authorized to work, but find yourself unemployed (TPS holders, DACA holders, Asylum applicants and adjustment pending applicants with EADs), you should be eligible to apply for unemployment, and it should not negatively affect a future application for legal permanent residence (green card application). This is because unemployment is an insurance that your employer pays into on your behalf. Thus, it is considered an "earned" benefit, not a "cash" or "cash equivalent" benefit. However, with unemployment being extended to the self-employed, it is not guaranteed that self-employed applicants will not suffer a negative note on their future legal permanent residence applications. It seems unlikely, but it is an unknown. It is important to remember that asylees who apply for legal permanent residence are not subject to the public charge rule, so they do not need to worry about this issue. CALIFORNIA'S CORONAVIRUS RELIEF FOR UNDOCUMENTED IMMIGRANTS Starting May 18, undocumented immigrants living in California can apply for the state's $125 million Disaster Relief Assistance for Immigrants (DRAI), created to support those not eligible to receive federal assistance or apply for unemployment benefits. To apply, you must: Be an undocumented adult (over the age of 18); Be a resident of California; Have evidence that you are not eligible to receive any federal coronavirus relief such as that provided in the CARES Act; and Have evidence that you have been impacted by the economic crisis resulting from the ongoing coronavirus pandemic. The relief will be paid by order of application on a first-come, first-serve basis ($500 for individuals who qualify and a maximum of $1000 in assistance per household) and will be available until all the funds have been distributed. Individuals may apply by phone by calling the nonprofit organization assigned to their county or region of residence. Below is a link with the list of nonprofit organizations by counties/regions: https://cdss.ca.gov/inforesources/immigration/covid-19-drai Please note that while this is not a means-tested benefit and the federal government has not listed list this one-time assistance as a public benefit under the new public charge rules, USCIS has not yet issued guidelines about whether this will affect public charge in an application for legal permanent residence (green card application).

700,000 teenagers and adults who were brought to the U.S. as children were given some immigration relief when the Obama administration established the DACA Program (Deferred Action for Childhood Arrivals) for those individuals who arrived as children, who had been present in the U.S. for a substantial period of time, who had a high school degree or equivalent, and had no criminal history. These "Dreamers" received work permits (at an annual cost of several hundred dollars for them) and did not have to worry about being deported provided they continued to have a clean criminal record. However, they have seen their fate in turmoil since the Trump administration decided to end the program in 2017. Court battles have kept the program alive since then (for renewals - but not new applications). However, the Supreme Court is now deciding the fate of the program and whether the Trump administration terminated the program according to applicable law. We expect a decision in late June (2020). It is recommended that all DACA holders apply for renewal prior to the beginning of June in case the program cancelled on account of the Supreme Court decision. As a note, there are an estimated 27,000 doctors, nurses, pharmacists, technicians, physician assistants, and home aides assisting in the fight against the Coronavirus who are Dreamers.